The Luxury Empire: LVMH's Most Notable Acquisitions Since Inception

Even though LVMH (Moët Hennessy Louis Vuitton) was formed in 1987, many of the luxury conglomerate's brands, or maisons, have roots dating back centuries. Through almost four decades of strategic mergers and acquisitions (M&A), Bernard Arnault has turned his vision of housing multiple prestigious maisons under one umbrella into a reality. In this article, we list and visualize LVMH's most notable acquisitions per year since inception.

Four Decades of Acquisitions

The entity we know as LVMH was originally established through a high-profile merger between Louis Vuitton and Moët Hennessy, which is where the acronym came from. The merger aimed to combine two distinct but complementary segments of the luxury industry: Moët Hennessy's expertise in champagne and cognac and Louis Vuitton's prominence in fashion and leather goods. The sly business tactics used by Bernard Arnault to finalize this huge deal is an article for another day, but if you want all the details we highly recommend Acquired's 3-hour LVMH deep dive podcast episode.

As the by far largest conglomerate of its kind, with Kering and Richemont as its closest peers, LVMH has become synonymous with luxury around the world. As of this writing, the company’s market cap is roughly €360 billion, making it the second biggest public company in Europe after Novo Nordisk and #20 in the world. Since the foundational merger finalized in 1989, Arnault has continuously diversified the group into a wider set of business segments while staying true to his vision of craftsmanship, creativity, and exclusivity. LVMH now divides its business into five segments across roughly 80 maisons; Fashion & Leather Goods, Selective Retailing, Watches & Jewelry, Perfumes & Cosmetics, and Other Activities of which the latter includes luxury hotels, yachts, and media companies.

The group's Chief Financial Officer Jean-Jacques Guiony talked about the strength and breadth of the LVMH brand portfolio during the Q3 2022 earnings call:

"There is no particular gap in the portfolio. We have 72 brands. I mean, we have the largest portfolio in the luxury industry. We have no particular need for acquisitions. But sometimes, we find a brand that we think we could do something with, so we buy it. But it's purely opportunistic."

–Jean-Jacques, Chief Financial Officer, LVMH

Diversified and Decentralized

For decades, Arnault has preached about the group's decentralized structure, with every maison having full creative control. In an excellent Harvard Business Review interview from 2001, Arnault said “You can't charge a premium price for giving people what they expect, and you won't ever have break-out products that way [...]. We have those, but only because we give our artists freedom.”. And a decade later, during the company's Q4 2010 earnings call, he kept hammering in the same message by comparing LVMH to a constellation of independent satellites.

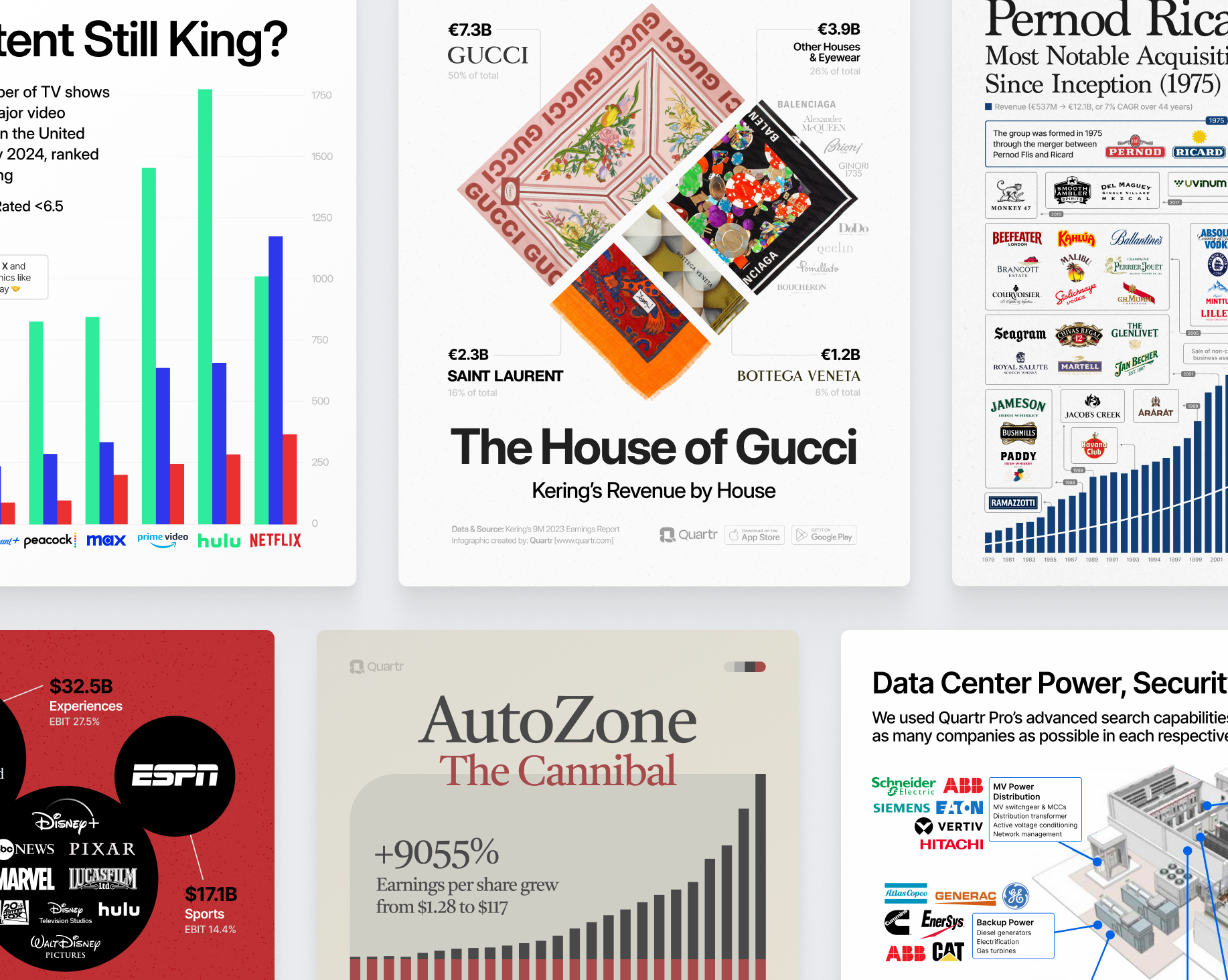

Some examples of diversifying acquisitions are Sephora, the French beauty retailer with a presence in over 35 countries, in 1998; the iconic Swiss watchmaker TAG Heuer in 1999; the Scottish whiskey distillery Ardbeg in 2004, which makes some of the most expensive whiskey in the world; the French newspaper Le Parisien in 2015; and the luxury travel giant Belmond in 2019. In the visual below, we have included every notable acquisition since 1989.

Visualizing 35 Years of Luxury Acquisitions:

LVMH's Most Notable Acquisitions Listed Chronologically:

1980's

Dior, est. 1946 (1987)

Louis Vuitton est. 1854 (1987)

Hennessy, est. 1765 (1987)

Moët & Chandon, est. 1743(1987)

Dom Pérignon, est. 1936 (1987)

Veuve Clicquot, est. 1772 (1987)

Givenchy, est. 1952 (1989)

1990's

Kenzo, est. 1970 (1993)

Investir, est. 1974 (1993)

Berluti, est. 1895 (1993)

Fred, est. 953 (1995)

Loewe, est. 1846 (1996)

Celine, est. 1945 (1996)

Sephora, est. 1970 (1998)

Marc Jacobs, est. 1984 (1998)

Duty Free Shoppers, est. 1960 (1998)

Krug, est. 1843 (1999)

TAG Heuer, est. 1860 (1999)

Chaumet, est. 1780 (1999)

Make Up For Ever, est. 1984 (1999)

Benefit, est. 1976 (1999)

Zenith, est. 1865 (1999)

2000's

Pucci, est. 1947 (2000)

Rossimoda, est. 1942 (2000)

Starboard Cruise Services, est. 1958 (2000)

Fendi, est. 1925 (2001)

Acqua di Parma, est. 1916 (2001)

Belvedere Vodka, est. 1910 (2002)

Ardbeg, est. 1815 (2004)

Glenmorangie, est. 1843 (2004)

Les Echos, est. 1908 (2007)

Royal Van Lent, est. 1849 (2008)

Hublot, est. 1980 (2008)

2010's

Moynat, est. 1849 (2010)

Nicholas Kirkwood, est. 2004 (2013)

Loro Piana, est. 1924 (2013)

Cova, est. 1817 (2013)

Repossi, est. 1957 (2015)

Le Parisien, est. 1944 (2015)

Rimowa, est. 1898 (2016)

Patou, est. 1914 (2018)

Fenty, est. 2017 (2019)

Belmond, est. 1976 (2019)

2020's

Tiffany & Co., est. 1837 (2020)

Off-White, est. 2013 (2021)

Officine Universelle Buly, est. 1803 (2021)

Pedemonte Group, est. 2020 (2022)

Quartr Pro is revolutionizing professional public market research

Request a personal demo to learn why Quartr Pro is quickly being adopted by leading asset managers, hedge funds, investor relations departments, and sell-side analysts worldwide.

Counter-cyclical Investments & Scale Advantages

And even though much of LVMH's manufacturing is made by hand in restricted quantities to maintain its exclusivity, or geographically constrained like its 200-year-old wineries in Champagne, the group enjoys other scale advantages. For example, cross-pollination of talent within the group, fruitful collaborations in between maisons, bulk-buying of advertising, and the combined muscle to take on opportunistic acquisitions or larger investments during economic downturns. In essence, LVMH's diversified and decentralized approach is developed to ensure the company's eternal survival.

Arnault on how LVMH uses economic downturns to their advantage, from the Q4 2022 earnings call:

"The desirability of our products and our presence throughout the world that is both dynamic and outstanding and has allowed us during these difficult years marked by the economic crisis in part and above all by the health crisis to increase our market share. As I’ve said on several occasions, in difficult times in terms of the macroeconomy or political difficulties, LVMH is gaining market share and making progress."

–Bernard Arnault, CEO, LVMH

LVMH leverages its existing distribution channels, both online and offline, to quickly enhance distribution and margins of acquired businesses. This not only diminishes a lot of the usual risks associated with acquisitions, but also means that LVMH can pay a greater price than its competitors but still get superior returns. The synergies within the group means that smaller brands most often can create more value under the LVMH umbrella than standalone. A great exception to this umbrella dynamic that we have to mention is Hermès, who still after almost two centuries operates successfully under one brand – having surpassed €12 billion in revenue (2023).

The $15.8B Tiffany Acquisition

LVMH's largest acquisition as of this writing, and one of the largest luxury acquisitions ever, was the 2020 public buyout of Tiffany – the almost two-centuries-old American jewelry maker known for its iconic turquoise boxes. In late 2019, the French luxury giant offered Tiffany’s shareholders $135 per share in cash. Although, as the Covid pandemic spread across the world in early 2020, the opportunistic and stiff-necked dealmaker Arnault saw a lucrative opportunity. After lowered bids, lawsuits, and antitrust investigations, the deal finally closed at $131.5 per share, or $15.8 billion, at the end of the year – saving LVMH almost half a billion dollars.

During the Q4 2022 earnings call, Arnault revealed that Tiffany’s profit had doubled since LVMH’s acquisition just two years earlier:

"Tiffany, for the first time, will exceed €1 billion in profit from recurring operations. We were barely at half that when we acquired the business, everyone said to me 'why are you buying this business at that price, it's far too much?' Well, if today, the business were to be listed, it would probably be worth twice as much."

–Bernard Arnault, CEO, LVMH

In conclusion

The journey of LVMH has been nothing short of extraordinary. Under the visionary leadership of Bernard Arnault, the luxury giant has masterfully built out and acquired its way to a global empire of maisons, each with its own creative freedom. The unique decentralized approach has allowed LVMH to preserve the desirability of its brands while driving creative innovation and operational excellence. We view LVMH as a great example of a company that has managed to utilize M&A as one of its core value-creation pillars.

Learn more about LVMH and Bernard Arnault

Why are finance professionals around the world choosing Quartr Pro?

With a broad global customer base spanning from equity analysts, portfolio managers, to IR departments, the reasons naturally vary, but here are four that we often hear:

)

)

)

)

)

)

)