Earnings Calls: A Key Part of Your Investment Strategy

In the rapidly changing and cut-throat competitive world of investing, staying informed is a necessity. Earnings calls and their transcripts offer a goldmine of insights, and neglecting them could mean missing out on pivotal information that could make or break your investment theses. If you’re not tuning into these calls or poring over their transcripts, now is the time to start.

The Opportunity You Can’t Miss

Through earnings calls, you get direct, unfiltered access to a company’s top management. This is the primary source where the CEO, CFO, and other key executives discuss financial results, strategies, and future plans.

While financial statements offer a snapshot of a company’s health and financials, earnings calls provide context and, as the analysts like to say, “color” to the reported numbers. The Q&A sessions can be particularly helpful, offering off-script conversations that provide deeper insights into the management and the overall company.

The calls can even help you catch red flags early. Subtle shifts in tone, cautious language about future developments, or discussions about challenges may indicate potential problems before they become evident in the financial statements. It’s like catching a cold; It doesn’t just appear out of the blue and you can often feel early indications of it.

Listening to these calls should be an integral part of your investment research, whether you’re laying the groundwork for a future investment or staying updated on your current portfolio. If none of your portfolio companies have a scheduled call this week, it’s the perfect opportunity to catch up on older calls or industry peers’ calls. It’s like a puzzle, and every piece of information can prove itself invaluable for dissecting the importance of future news or other developments.

For example, in an earnings call, a tech company might delve into customer acquisition costs or lifetime value metrics, whereas a manufacturing firm might discuss capacity utilization rates or commodity price impacts. By listening in, you can refine your understanding of what drives value in various industries.

Step Outside the Bubble

You’ve most certainly felt how easy it is to become stuck in an echo chamber of similar opinions on social media and investment forums. Earnings calls could act as a remedy to this. They allow you to form your own opinions based on direct information from the source rather than relying on third-party interpretations.

Moreover, questions posed by analysts during these calls can sometimes challenge the company executives in ways that press releases and scripted statements do not. This back-and-forth can bring truths to the surface without the usual sugar-coating. This way, you get a clearer picture of what’s actually going on and can make smarter decisions with your money.

Where to Access Earnings Calls?

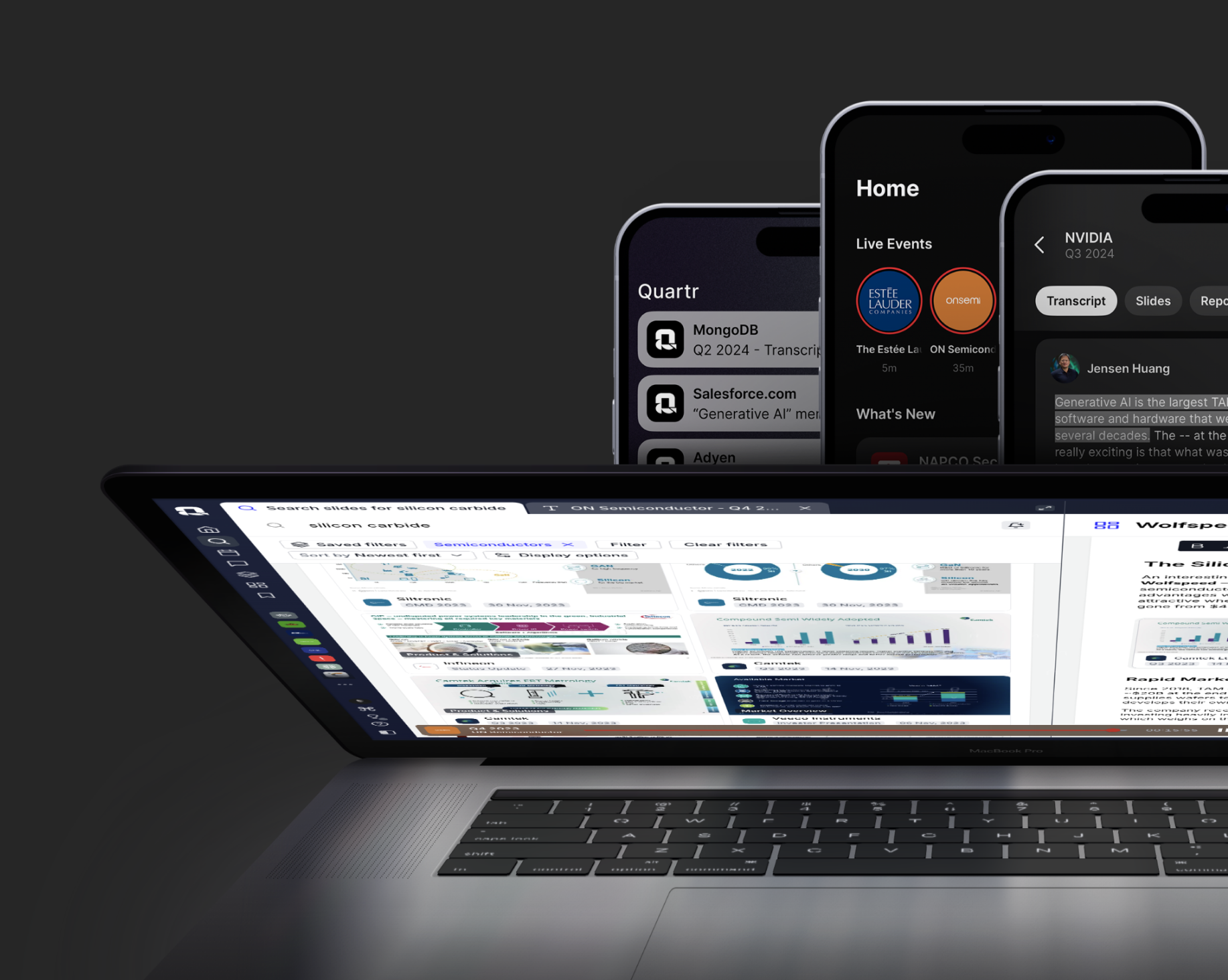

Through the Quartr Mobile App and Quartr web app (Core and Pro), you gain access to earnings reports and slides along with earnings calls in a podcast-like format, both live and in replay, at adjustable speeds. Quartr also provides fully searchable transcripts and personalized notifications, ensuring you never have to refresh an investor relations page again. This user-friendly interface combined with a fully customizable event calendar, is designed to make the process of staying updated with your investments more convenient than ever.

Concluding thoughts

Earnings calls are an essential tool for any serious investor. They offer a depth of understanding that can’t be replicated by third-party summaries or reports. By directly engaging with these calls, you become better equipped to make informed decisions, spot opportunities, and identify risks. So next time an earnings call is scheduled, mark your calendar—it might just be the most important thing you listen to all quarter.

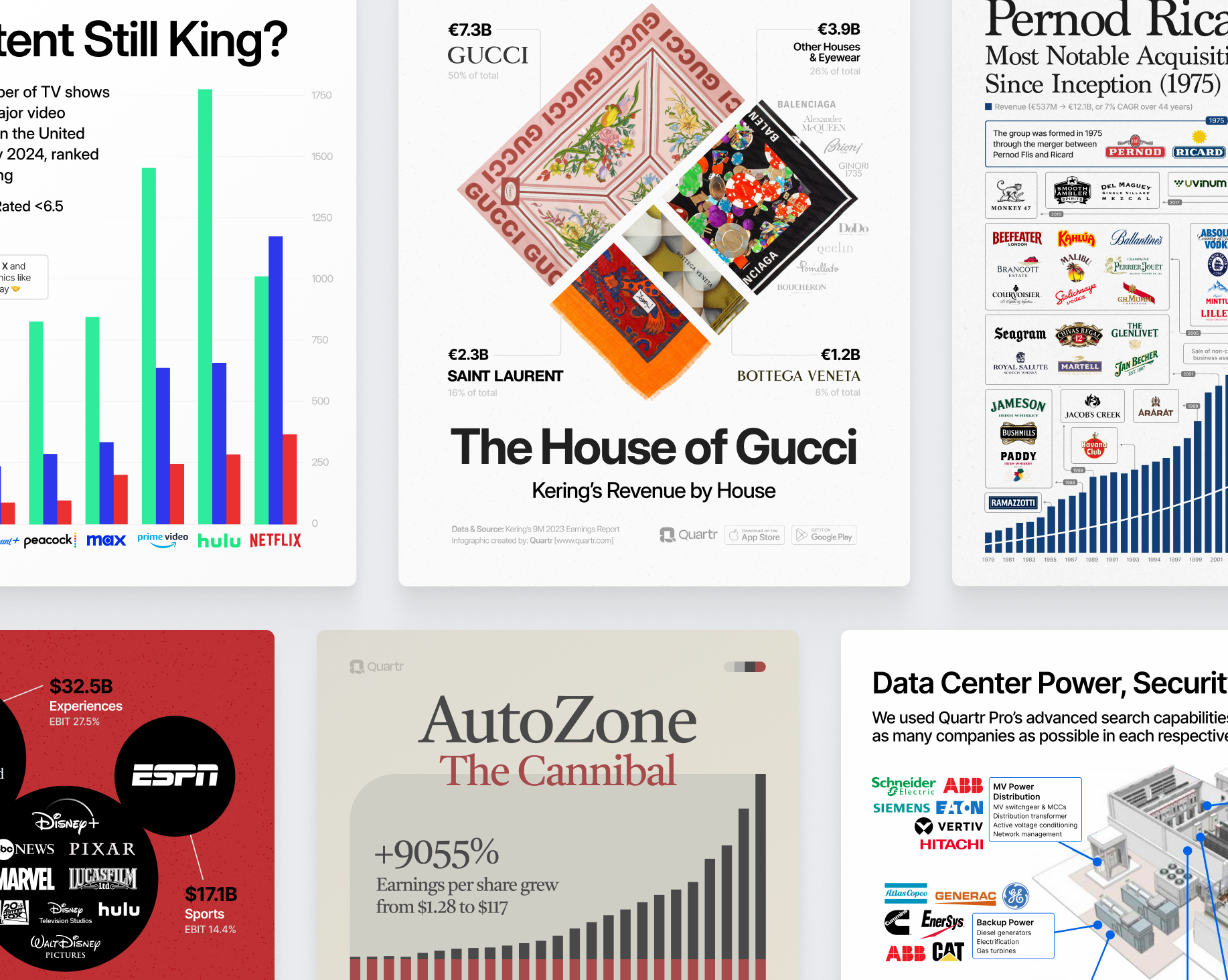

Why are finance professionals around the world choosing Quartr Pro?

With a broad global customer base spanning from equity analysts, portfolio managers, to IR departments, the reasons naturally vary, but here are four that we often hear:

)

)

)